Checks for individual profiles

The following checks can be run on individual profiles:

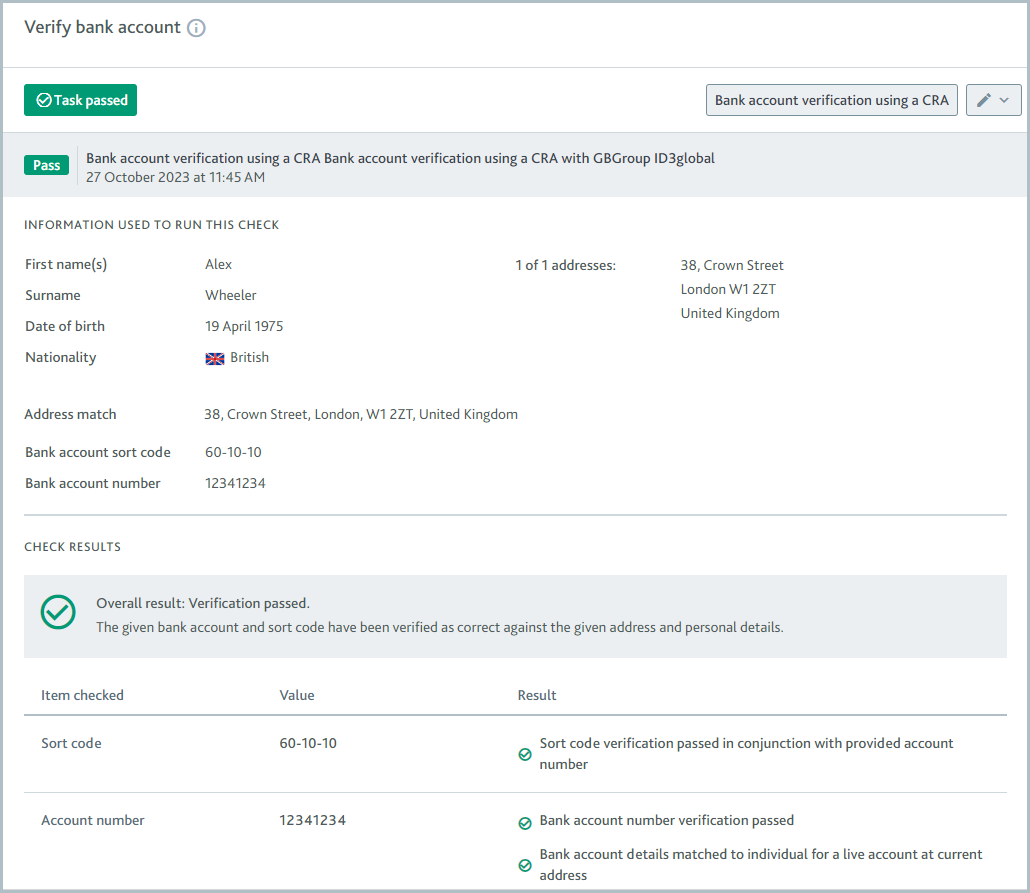

Bank account verification using a CRA

Used for the Verify bank account task.

This check confirms whether an individual’s bank account and personal details are correct and associated with a legitimate bank account.

The check is performed by cross-referencing the individual’s details with the data provider’s credit rating agency (CRA).

The possible results for this check are Passed, Failed, and Error.

The result details display any information that was successfully matched in the CRA.

For more information about the check variant, see the data provider topic:

API name: CRA_BANK_ACCOUNT_VERIFICATION

Device fraud detection

Used for the Assess device reputation task.

This check assesses whether the individual's device is reputable.

This check is performed by sending the device details to the data provider who checks for signs of fraud.

The possible results for this check are Passed, Review, Failed, or Error.

The result details show the total transaction score, the matched rules, and any device and IP location information returned from the data provider.

It is not possible to configure the Device fraud detection check to run automatically. The Device fraud detection check does not have ongoing monitoring.

Learn how to run the check via the API.

To learn about the check variant, see the data provider topic:

API name: DEVICE_FRAUD_DETECTION

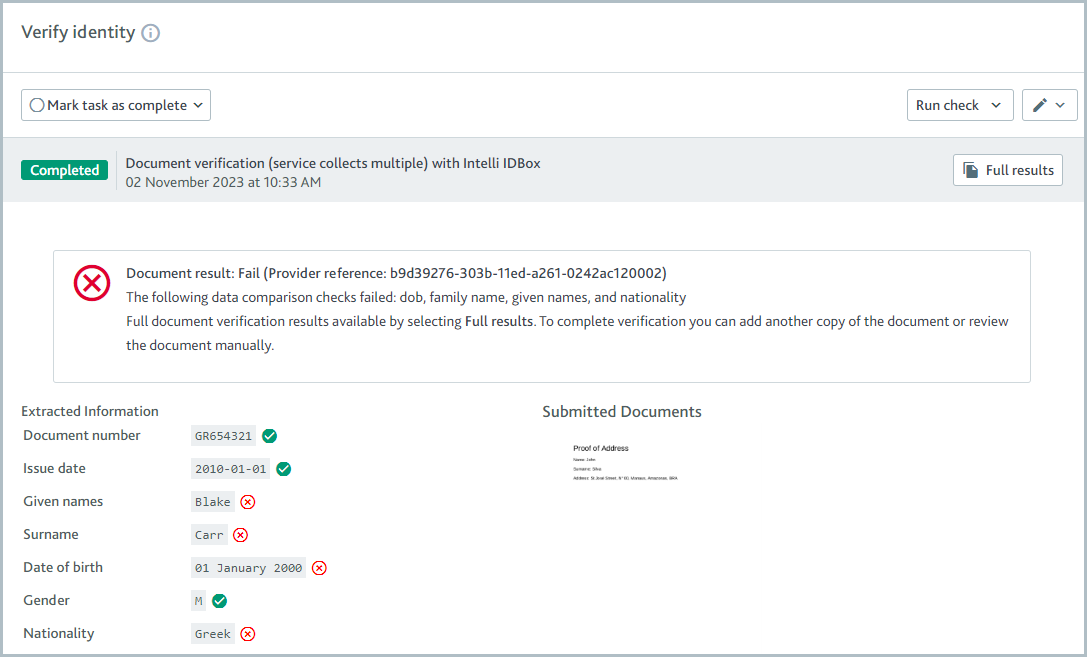

Document verification (service collects multiple)

Used for the Verify address and Verify identity tasks.

This check confirms whether an individual’s proof of address and proof of identity documents are valid.

The customer submits one document for proof of address and/or one document for proof of identity to the data provider, who checks for signs of forgery.

The data provider also extracts the customer’s details from all documents and those details are cross-referenced with the profile’s details to ensure they match.

The results of each document are displayed on the relevant task. If a proof of address document is returned, the results are displayed on the Verify address task. If a proof of identity document is returned, the results are displayed on the Verify identity task. For each task, an image of the relevant document is displayed, along with any extracted data.

Each document has a document result. The check variant determines whether the document result is passed or failed. For example, the document result might be passed when the data provider confirms the document is valid and the extracted details match the profile details. If the check is configured as an acceptance check, the task is marked as passed when the document result is passed.

Independently, the check also has a check result, which can be completed or failed. If any documents are sent to Passfort, the check result is completed, regardless of whether those documents are valid or invalid. If no documents are sent, the check result is failed.

When the check is run manually, the check result is shared across the Verify address and Verify identity tasks, so the check on both tasks is completed or the check on both tasks is failed. This means that if only one document is returned and therefore only one task has document results to show, the other task will be marked as completed even though the document results look empty.

When the check is run automatically, it only runs on the tasks it's configured to run on, meaning it's possible for the check to run on the Verify address task but not on the Verify identity task and vice versa. If you would like the automatic check experience to mimic the manual check experience, configure the Document verification (service collects multiple) check as an automatic check on both the Verify address and Verify identity tasks.

Note

Each task also has a status that can be completed as passed or failed. Tasks can have separate statuses even when the check result is shared across them.

To learn about the check variant, see the data provider article:

API name: DOCUMENT_CAPTURE

Electronic identity check

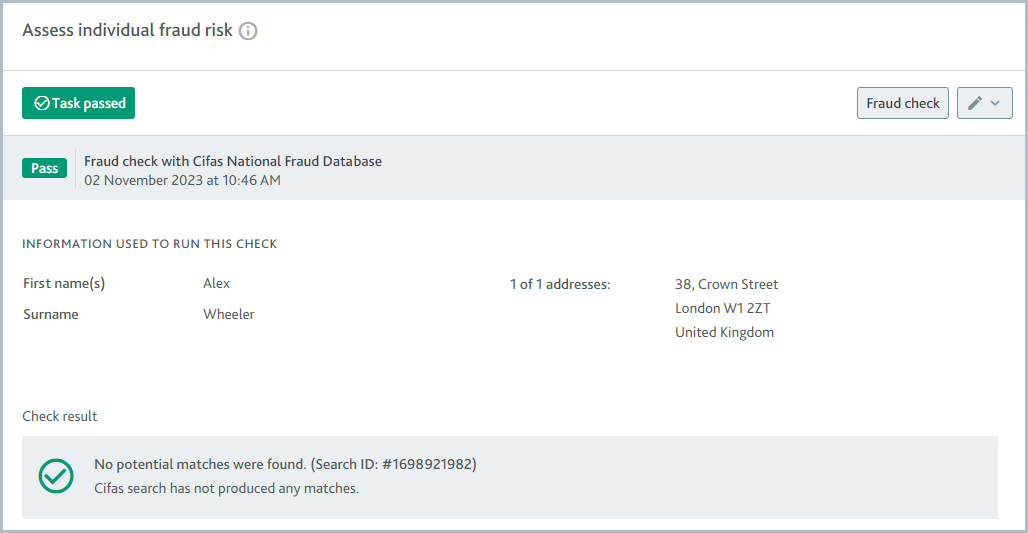

Fraud check

Used for the Assess individual fraud risk task.

This check assesses whether the individual has any matches in the Cifas National Fraud Database.

This check is performed by sending the individual's details to Cifas, who cross-references them in their National Fraud Database.

The possible results for this check are Passed, Review, or Error.

The result details show the number of potential matches found in the database and the Search ID that you can use to see the results in the Cifas portal.

The Fraud check does not have ongoing monitoring.

Learn how to run the check via the API.

To learn about the check variant, see the data provider topic:

Configuring Cifas National Fraud Database

API name: FRAUD_SCREENING

Geocoding check

Used for the Verify address task

The check finds the coordinates for an address.

The check is performed by sending an address to the data provider, which confirms the address is valid and returns the latitude and longitude.

The possible results for this check are Passed, Failed, and Error.

This check is always run from the API. It cannot be configured as an automatic check.

Once the coordinates have been determined, they can be used for the Geodistance check to calculate the distance between the individual's stated address and their current location.

Learn how to run the check using the API and see the results in the portal.

To learn about the check variants, see the data provider information:

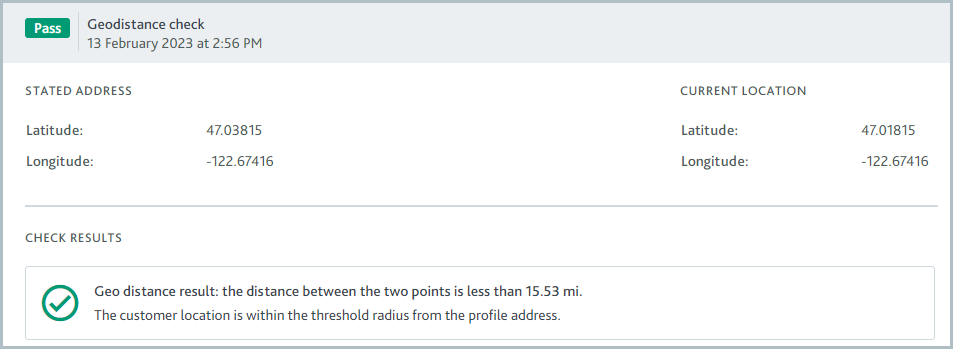

Geodistance check

Used for the Verify address task.

This check confirms whether the individual's stated address and their current location are within the proximity threshold. You specify what the threshold will be when you configure the data provider.

The check is performed by taking the latitude and longitude of each location, then calculating the distance between them to confirm whether they're within a specified threshold.

The possible results for this check are Passed, Failed, and Error.

The result details display the distance between the two points in miles.

The distance is measured as a direct path between the two points. It does not account for any mountains, rivers, and so on. This check is always run from the API. It cannot be configured as an automatic check.

Learn how to run the check via the API and see the results in the portal.

To learn about the check variants, see the data provider topic:

ID verification (Passfort collects documents)

Used for the Verify address, Verify identity, and Verify tax status tasks.

This check confirms whether an individual’s proof of identity document is valid.

If you're using this check on the Verify tax status task, the tax documents are always verified manually.

If you're using this check on the Verify address or Verify identity task, you can choose to configure this check so documents are verified manually or verified by a data provider.

Alternatively, if you would like to use a data provider to verify documents, the check works as follows.

You upload an individual's document to Passfort. Passfort submits the document to the data provider, who checks for signs of forgery.

The data provider also extracts the customer’s details from the document. These details are cross-referenced with the profile’s details to ensure they match.

Some data providers perform additional actions before the task is passed, such as police checks and selfie checks. Contact your data provider to find out what services they offer.

The possible results for this check are Passed or Failed. The check variant determines when each result is returned.

The result details display an image of the document.

To use this check to verify an individual’s address, ensure that:

The documents provided contain proof of address as well as proof of identity, for example, a driver’s license.

Your data provider extracts addresses from documents.

It's not possible to use this check with Onfido on the Verify address task because Onfido does not extract addresses from documents.

This check cannot be configured as an automatic check.

Some data providers offer services that check the quality of photos of documents to ensure they’re clear enough to be analyzed. Where possible, we recommend using ID verification (service collects documents) instead of ID verification (Passfort collects documents) because it enables these services to be used. Contact your data provider to find out what services they offer.

Learn how to run the check from the portal and from the API.

To learn about the check variants, see the data provider topics:

If you choose to always run the check manually rather than with a data provider, the provider is displayed as Manual Validation Only.

API name:DOCUMENT_VERIFICATION

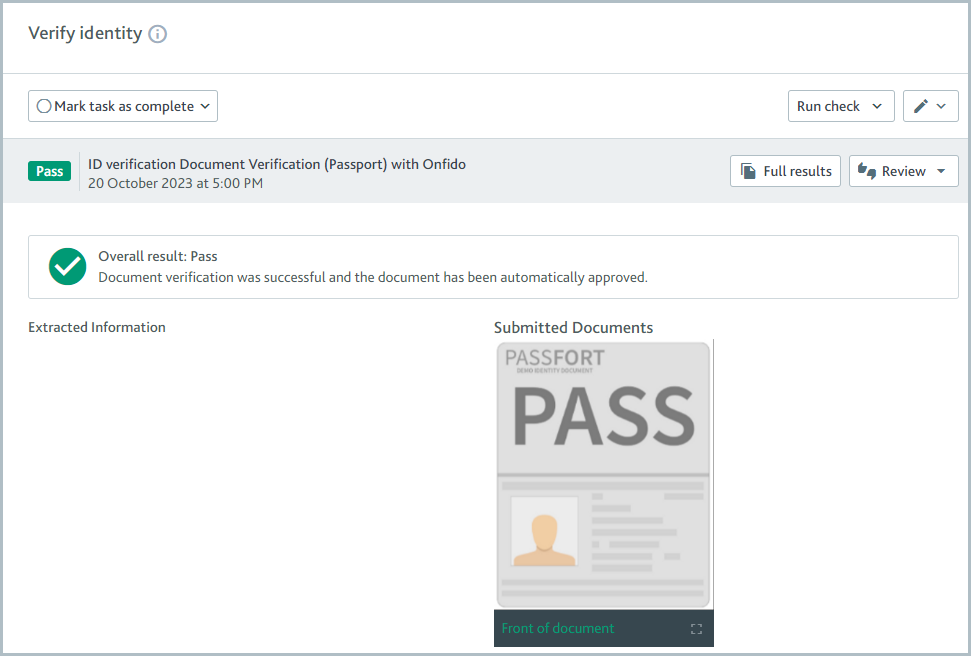

ID verification (service collects documents)

Used for the Verify address and Verify identity tasks.

This check confirms whether an individual’s proof of identity documents are valid.

The customer submits their documents to the data provider, who checks for signs of forgery.

The data provider also extracts the customer’s details from the document. These details are cross-referenced with the profile’s details to ensure they match.

Some data providers perform additional actions, for example, police checks, selfie checks, and liveness checks. Contact your data provider to learn what services they offer.

The possible check results are Passed or Failed. The check variant determines when each result is returned.

The result details display an image of the document and any information extracted from the document.

To use this check to verify an individual’s address, ensure that:

The documents contain proof of address as well as proof of identity, for example, a driver’s license.

Your data provider extracts addresses from documents.

It's not possible to use this check with Onfido on the Verify address task because Onfido does not extract addresses from documents.

This check is run manually. It cannot be configured to run automatically. Learn how to run this check using the API.

To learn about the check variants, see the data provider topics:

API name: DOCUMENT_FETCH

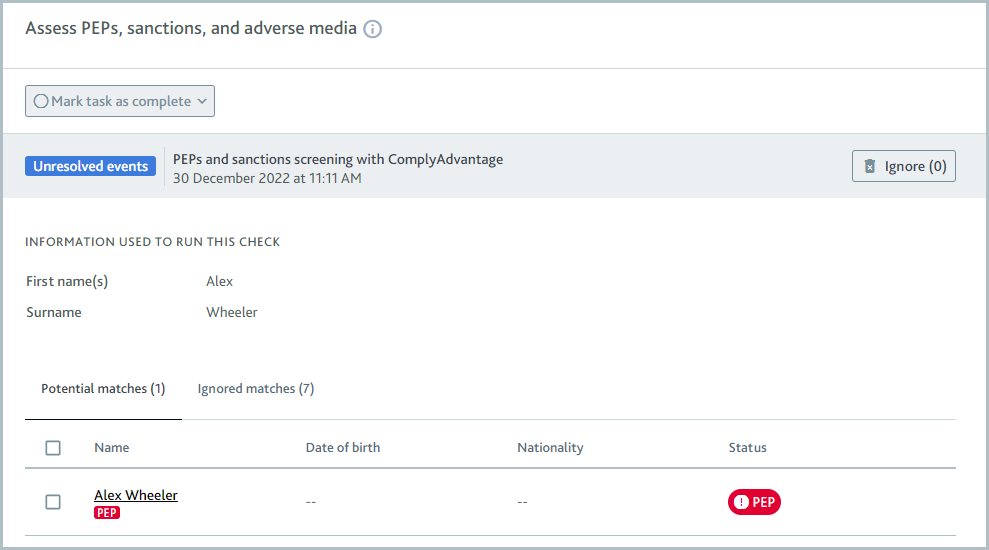

PEPs and sanctions screening

Used for the Assess PEPs, sanctions, and adverse media task.

This check provides a list of an individual's potential matches to sanctioned persons, politically exposed persons (PEPs), and, if you have access to adverse media results through your data provider, instances of adverse media.

The check is performed by screening the individual through the data provider’s official sanctions lists and sources.

The possible check results are Completed or Unresolved events. The check variant determines when each result is returned.

The result details display two lists:

Potential matches: The potential matches returned by the data provider. You can choose to ignore any match on this list.

Ignored matches: The matches you have chosen to ignore. If you’re using Passfort false positive reduction service, any false positive matches are also displayed here. You can choose to confirm any match on this list.

Click the name of any match, potential or ignored, to see a detailed portfolio that provides the available information from the data provider about the match’s biography, associates, political exposure, events, and sources.

When you create an event with no check id, using POST /profiles/<uuid:profile_id>/events in the API, these are listed under Screening matches from the Passfort API.

If there are no potential matches for the individual, the check results display a message that says "There are no potential matches to investigate."

Some data providers offer additional services to filter out false positives. If you’re using one of these services, false positives identified by your data provider aren’t displayed in Passfort. Contact your data provider for more information about how they determine false positives and where you can see them.

To learn about the check variants, see the data provider topics:

API name: PEPS_AND_SANCTIONS_SCREEN

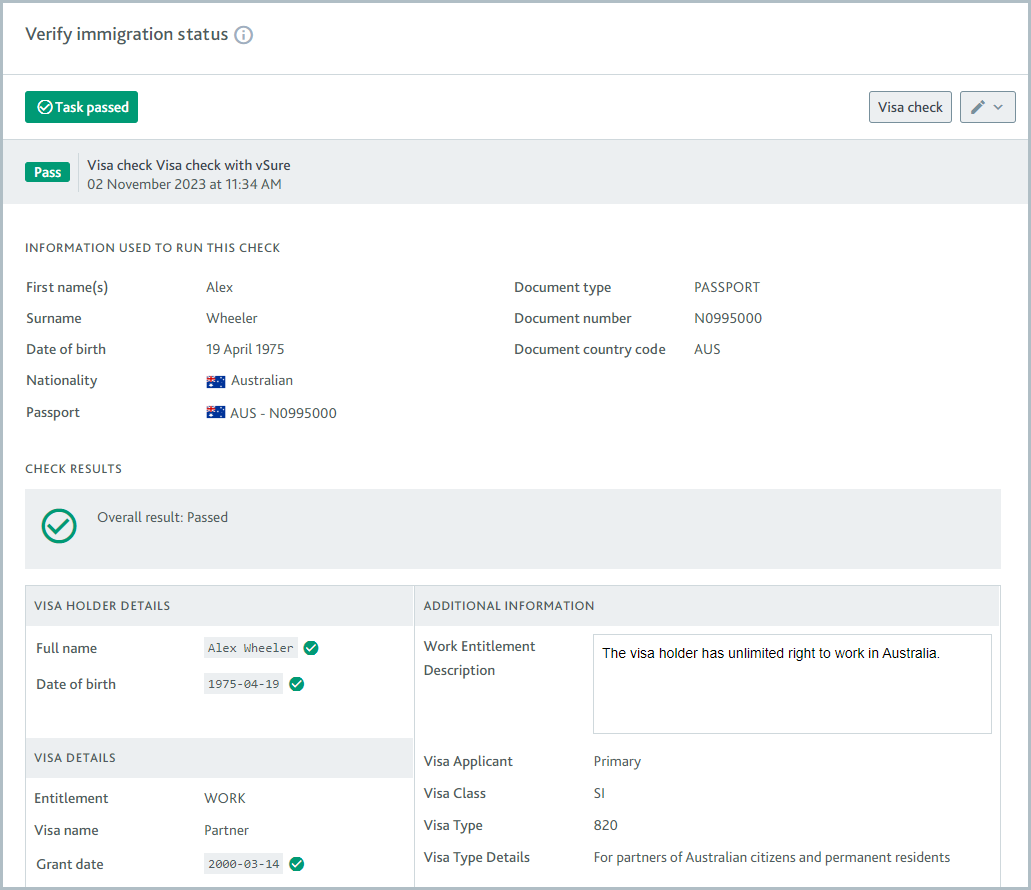

Visa check

Used for the Verify immigration status task.

This check confirms whether an individual’s personal details and passport details are correct and associated with a valid work or study visa.

The check is performed by searching for the individual in the data provider’s database.

The possible check results are Passed or Failed. The check variant determines when each result is returned.

The result details display information about the visa.

It is not possible to configure the Visa check to run automatically.

Learn how to run this check using the API.

To learn about the check variant, see the data provider topic:

Each check variant with vSure can only be used to search for either work visas or study visas. To use vSure to search for both, set up one check variant with each, then configure the check variants as a waterfall.

API name:VISA_CHECK