Sanctions360 ownership definitions

The following examples illustrate how Sanctions360 identifies companies that are owned 50% or more by sanctioned entities. There are five types of ownership definitions:

In each example, S is an example of an entity on a sanctions list.

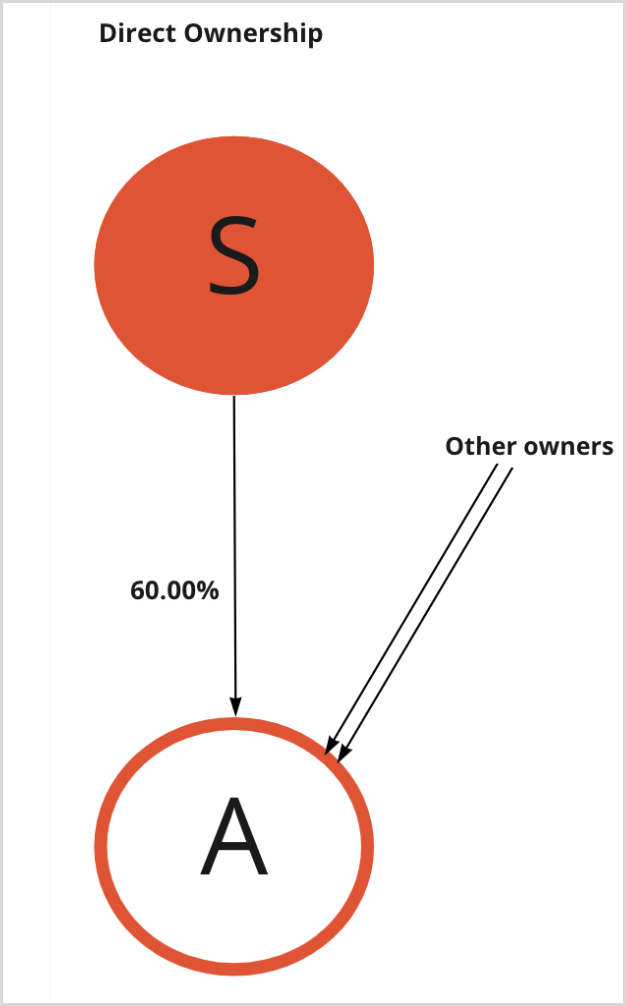

Direct ownership

The sanctioned company S owns 60.00% of company A. Company A is therefore sanctioned by extension.

|

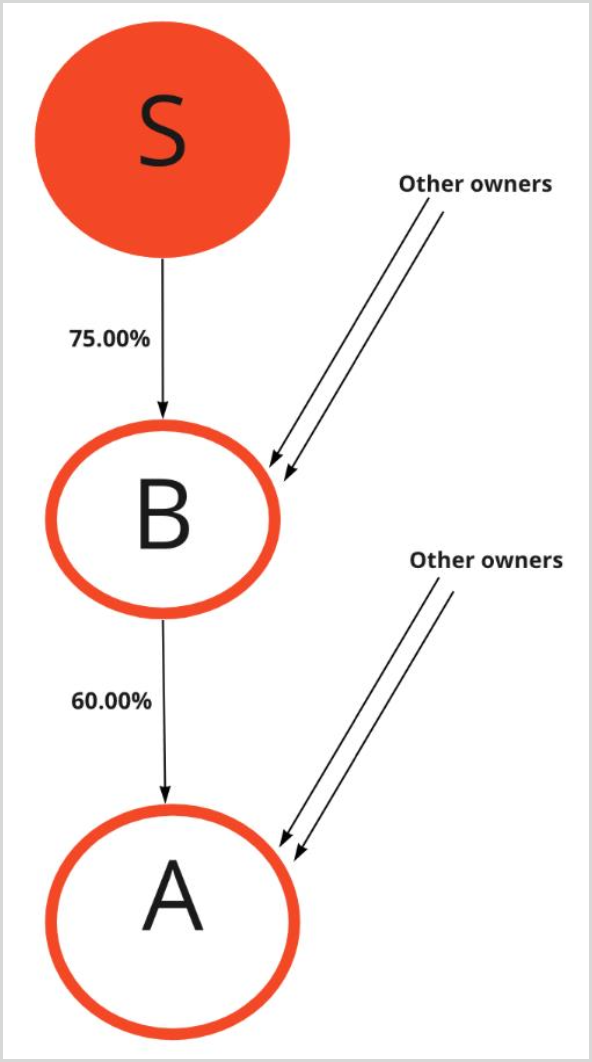

Single-path indirect ownership

The sanctioned company, S, owns 75.00% of company B. Company B is sanctioned by extension. Company B owns 60.00% of company A and therefore Company A is also sanctioned by extension. In other words, there’s a chain of majority ownership links from sanctioned company S to company A.

Company A is considered sanctioned by extension because company S has direct majority ownership of company B and company B has direct majority ownership of company A. This is sometimes referred to as the cascade-down effect.

|

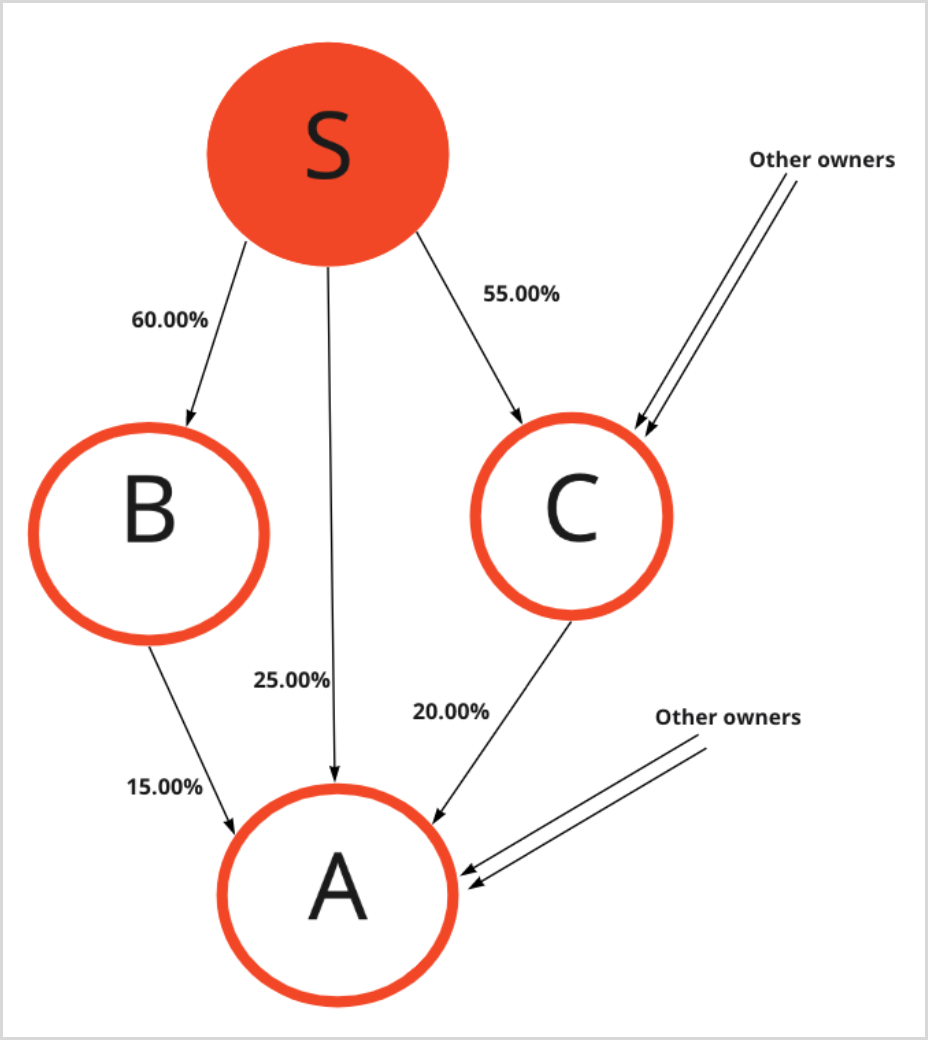

Multiple-path indirect ownership

The sanctioned company S:

owns 60.00% of company B, which owns 15.00% of company A

owns 25.00% of company A

owns 55.00% of company C, which owns 20.00% of company A

Company A is sanctioned by extension.

Company A wouldn't be considered sanctioned by extension if sanctioned company S only had 25% direct ownership of company A. However, there are also two indirect paths from sanctioned company S to company A through companies B and C, which are themselves sanctioned by extension due to sanctioned ownership. Therefore, because the sum of all direct percentages of B-S-C into A equals 60.00%, company A is sanctioned by extension.

|

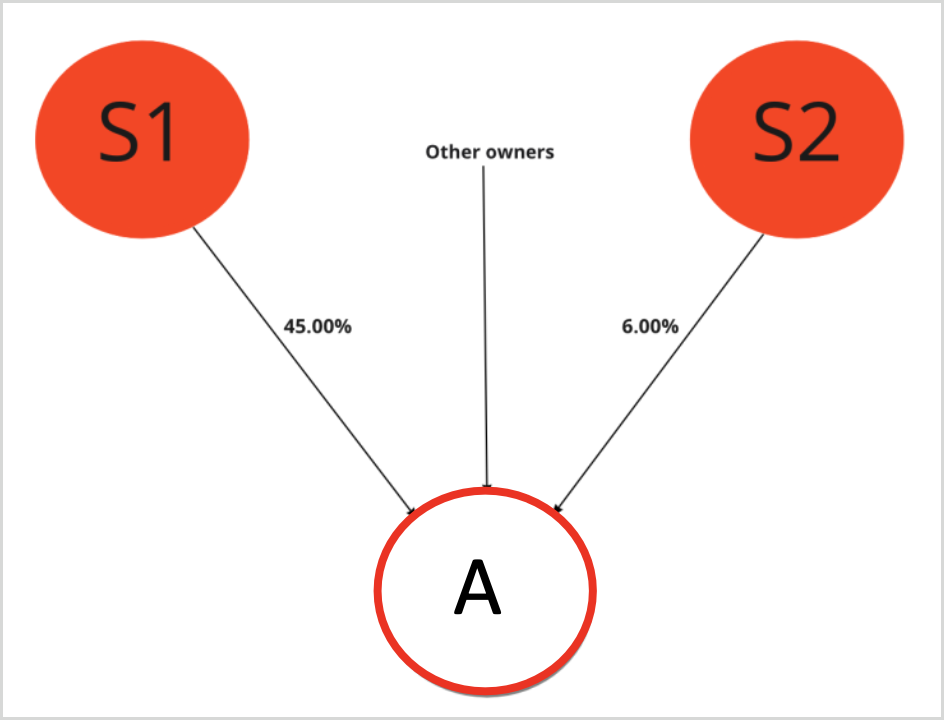

Aggregated ownership

The sanctioned company S1 owns 45.00% of company A and sanctioned company S2 owns 6.00% of company A. Company A is sanctioned by extension.

Neither company S1 nor company S2’s ownership shares alone are sufficient for company A to be sanctioned by extension. However, since the sum of both ownership percentages (45% + 6%) equals more than 50.00%, company A is considered sanctioned by extension.

|

Branch, foreign company, marine vessel, and others

A numerical percentage of 100% is attributed to branches, foreign companies, sole traders, and marine vessels. They are therefore included in the sanctioned by extension calculations.

A numeric substitution is done for wholly owned (WO) or majority-owned (MO) companies. WO is considered 98% owned and MO is considered 50.01%.

Other types of companies that have an ownership link without any numeric substitution are disregarded. This includes managed funds, general partners, and advisors.